Since publishing two books, I maintain the philosophy developed through my research in the book Shaking the Globe. Namely, the thesis presents the importance to Seek Competence, Show Empathy and Invest in Progress. In 2025, to simplify my life (and the website), I am focusing on the three-prong strategy to personal fulfillment and gratitude.

To SEEK COMPETENCE means I continue to read over 60 books per year and in the Readings section, suggest several books to read. I do not overlap the choices of Bill Gates in his book list. I do think some of the books he suggests are worth reading—particularly The Coming Wave. Understanding the applications of Artificial Intelligence is one of the most critical changes in our communications for today and tomorrow. According to Forbes magazine May 19, 2023, Bernard Marr wrote:

OpenAI released an early demo of ChatGPT on November 30, 2022, and the chatbot quickly went viral on social media as users shared examples of what it could do. Stories and samples included everything from travel planning to writing fables to code computer programs. Within five days, the chatbot had attracted over one million users.

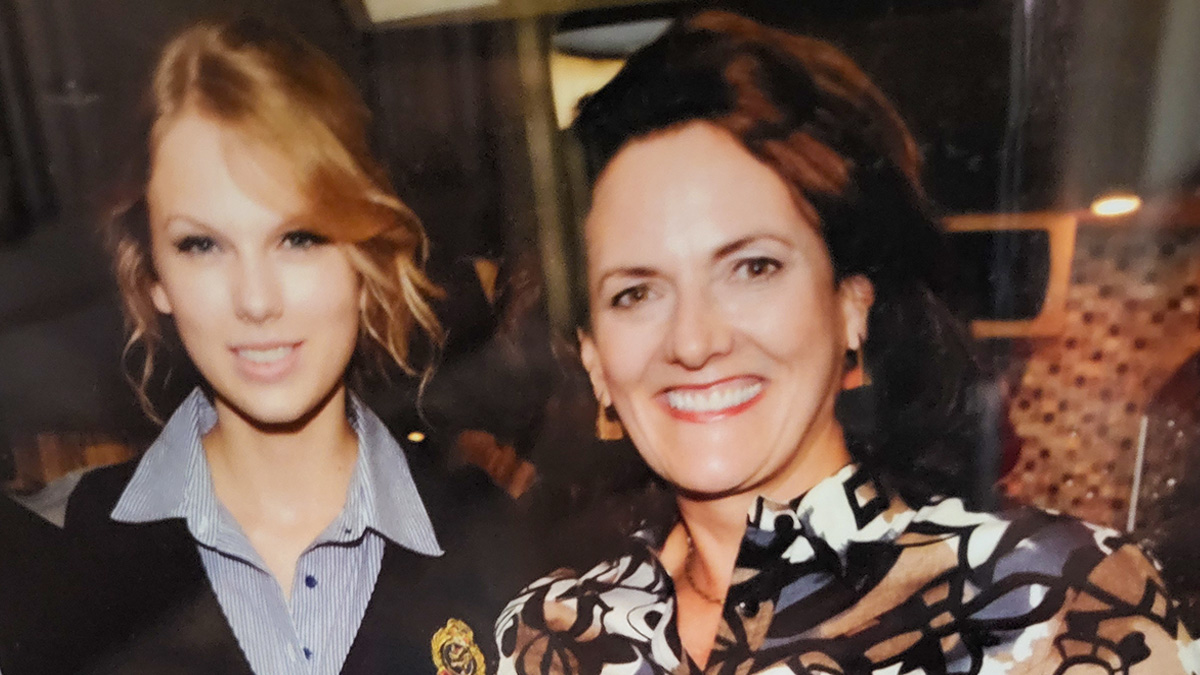

To SHOW EMPATHY means increasing my philanthropic giving and attention. The three most important communities which matter to me are Music, particularly the Lyric Opera of Chicago; The Nature Conservancy, particularly Foodscape: Regenerative Agriculture in the Midwest U.S.; and Higher Education, particularly in American History.

To INVEST IN PROGRESS means working on corporate Board of Directors for companies which align with my values. On the website, we have included several channels in which I express my values. To quote Francis Bacon, “Reading maketh a full man; conference a ready man; and writing an exact man.” He explores the dynamic of intellectual growth e.g., challenging our pre-conceived ideas and encouraging an understanding of different perspectives. While I am not a man, substitute the word woman and I agree with the statement.